Financial Literacy

“This course was useful because it showed us so many different options on how to save for the future and retirement. ”

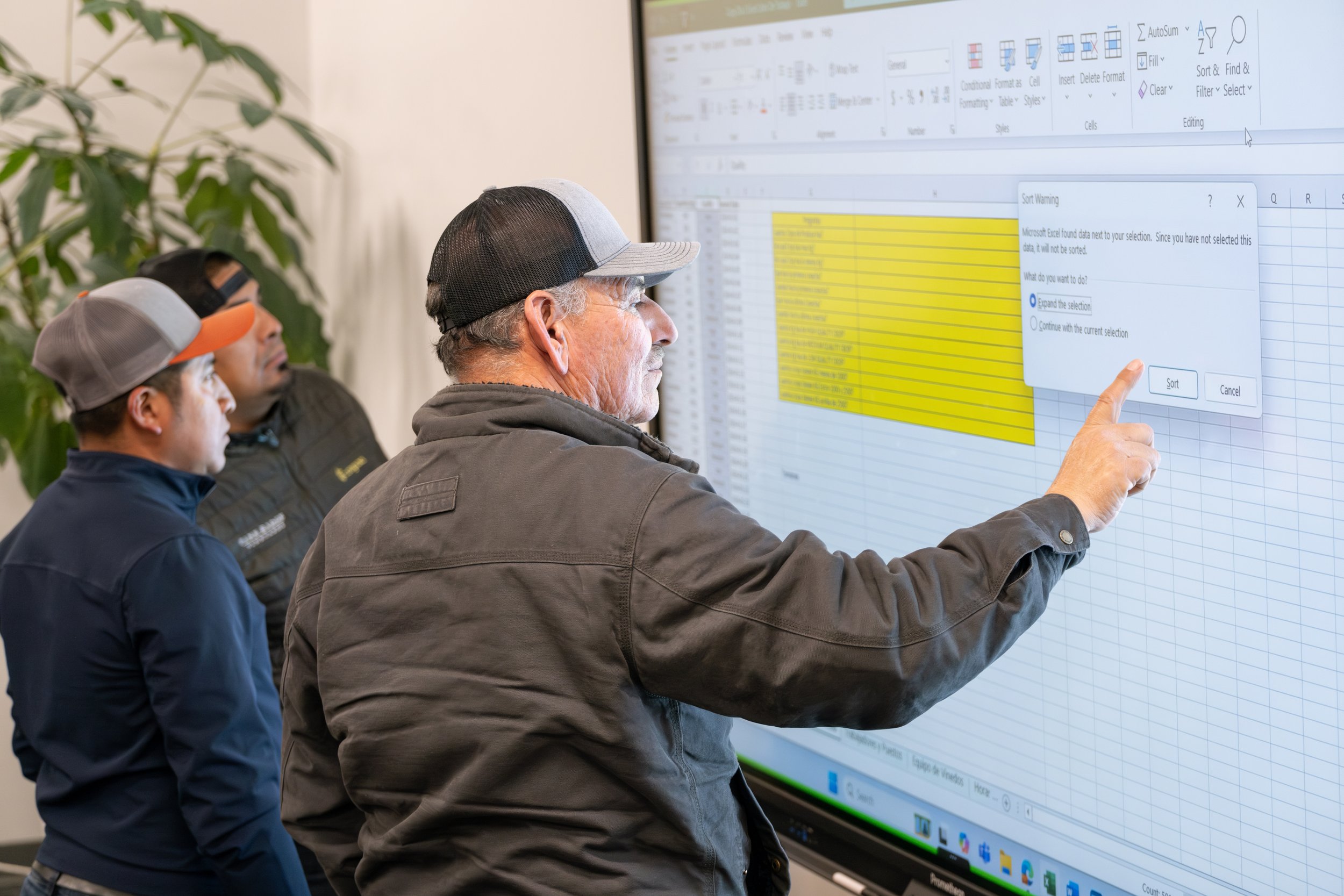

Financial knowledge creates opportunities, and the Farmworker Foundation’s Financial Literacy Program provides essential tools for making informed financial decisions. Through video libraries, interactive workshops, and expert guidance, farmworkers gain valuable insights and practical instruction in budgeting, wages, benefits, debt management, and financial services.

Investing time in financial education leads to greater stability, security, and confidence in planning for the future. Designed specifically for Napa County farmworkers, these presentations offer practical insights to navigate the financial landscape for individuals, families, and careers.

Taking control of financial well-being today creates pathways for a more secure and prosperous tomorrow.

Upcoming Financial Literacy Programming

The Importance of Financial Literacy

As Napa Valley continues towards a more year-round, permanent vineyard workforce, the need to support farmworker families through financial literacy education becomes much more important. Understanding how to manage money effectively gives individuals the tools to make informed decisions that increase financial wellness, resilience, and long-term financial stability. With better financial skills, one can define one's future, better manage unexpected crises, plan a retirement, and begin to build inter-generational wealth, leading to a reduction in stress and improvement in overall well-being.

Financial Literacy Video Series

The Financial Literacy Series features expert-led videos tailored to the farmworker community, covering essential topics such as budgeting, credit, and long-term financial planning:

Budgeting for Emergencies, with Martin Curiel, MYeCFO

Understanding the 2024 Harvest from a Financial Perspective, Rolando Sanchez, Walsh Vineyards Management

Make Your Money Work, What You Need to Know About Investing, with Martin Curiel, MYeCFO

Budgeting and Future Projections for Farming Operations with Rolando Sanchez, Walsh Vineyards Management

Calculating Cost of Grapes Per Vineyard Acre with Enrique Herrero, Inglenook Winery

Investing for the Future with Steve Faggiolly, Strategic Retirement Partners

Navigating the American Retirement System with Strategic Retirement Partners

Matching Farming Practices to Operation Goals with Julio Rodriguez Buren, Carlos Danti, and Rolando Sanchez

Common Workplace Calculations with Rodrigo and Professor Guillermo Gonzalez

Steps to Owning a Home with Redwood Credit Union

Tax Preparation Resources with UpValley Family Centers

Assessing Credit with Redwood Credit Union

Fraud Protection with Redwood Credit Union

Personal Budgeting for the Year Ahead with Wells Fargo

Managing Credit and Debt with Redwood Credit Union